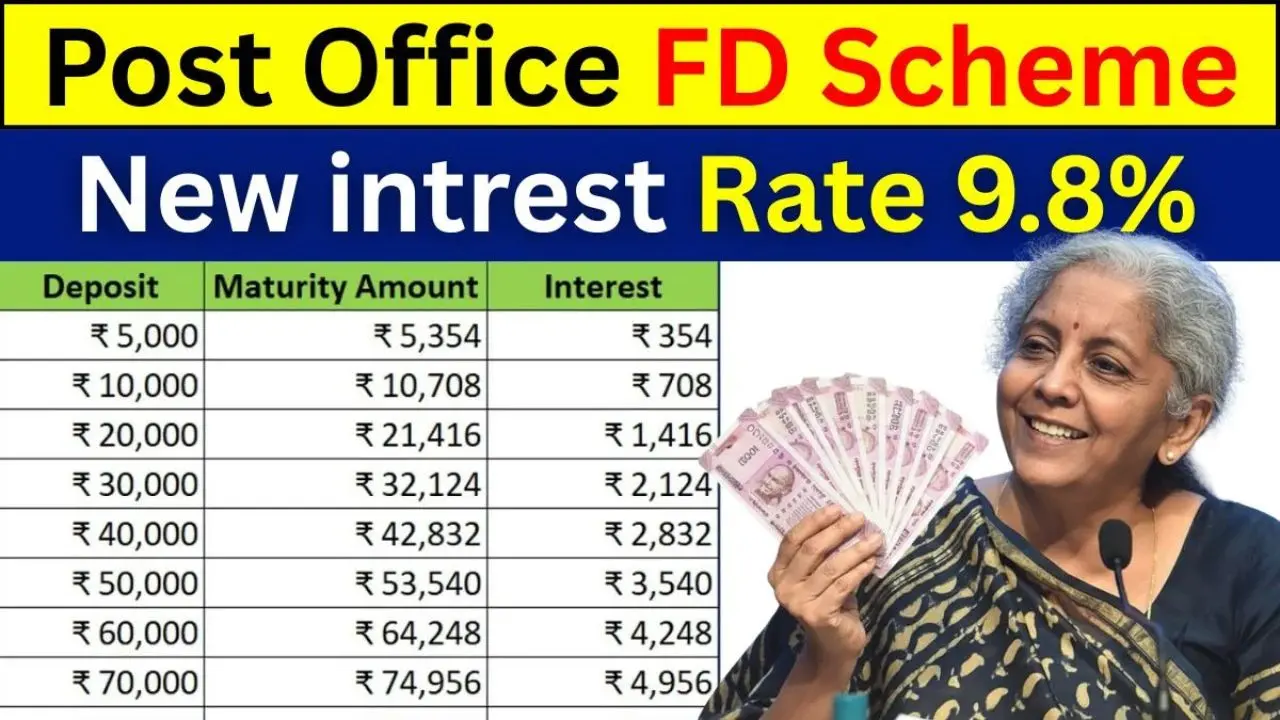

A Post Office fixed deposit is considered one of the highest-grade and safest investment instruments, wherein you may enjoy guaranteed returns. In terms of investment size, in the government-backed Post Office FD scheme, even half-hearted investment initiatives can give rise to handsome wealth over a period of time. For instance, if someone puts away ₹5.5 lakhs today, that amount shall convert to roughly ₹11,59,958 by the time the FD matures, showing how potent the phenomenon of compounding is.

About Post Office FD Scheme

Post Office FDs are a fixed-income investment offered by the government of India. They are a fixed term from one to ten years; it earns a fixed rate of interest for the length of time your money lies in the account. This interest gets compounded either quarterly or annually, depending on the scheme, with full assurance from the government. The assurance makes an FD one of the safest investment avenues for a conservative investor who wishes to protect the principal, all the while earning a steady return.

How ₹5.5 Lakh Grows to ₹11,59,958

If an investor makes a deposit of ₹5.5 lakh into a 10-year Post Office FD at the at-that-time interest rate of 7.1% per annum, compounded quarterly, the maturity proceeds would amount to approximately ₹11,59,958. This consists of ₹5.5 lakhs being the principal sum plus ₹6,09,958 being interest accumulated. Because of compounding, interest returned in some of the earlier periods would still earn returns, thereby giving rise to an exponential return in the long term.

Tax Benefits and Safety

Investment in Post Office FD offers partial tax benefits under Section 80C of the Income Tax Act for some schemes, subject to Rs. 1.5 lakh per annum. As the scheme is government-backed, it entails virtually no risk of capital loss, thus imparting the much-needed assurance to investors who value safety above market-linked returns.

Why Choose Post Office FDs

Post Office FDs are meant for disciplined savings with assured growth. They implement the saving concept for salaried individuals who wish to build up a corpus over a medium to long-term horizon or are in a phase to stay risk-averse on the protection of wealth, retirees, and anyone with such mindset. By starting early and investing systematically and consistently, even a one-time investment of ₹5.5 lakh almost doubles into a huge sum within ten years.

Conclusion

Post Office FD Scheme is the best example for demonstrating safe, long-term investing. In such a security, if 5 1/2 lakhs were invested today, a guaranteed return of 11,59,958 rupees would be realized at maturity. This is a very safe way of growing money steadily.